Texas Land Markets Are on Fire: First Quarter 2021

This article is featured in the Summer 2021 issue of Texas LAND magazine. Click here to find out more.

Texas land markets exploded in the first quarter of 2021, posting a preliminary total of 8,147 transactions, a 33.17 percent surge over 2020 levels. (All figures reflect annualized quantities in four-quarter moving averages.) Urban dwellers fleeing cities and investment-driven buyers led the charge into the countryside, snapping up nearly everything offered for sale. This frenzied demand drove prices 9.43 percent higher than 2020 first quarter prices. The remarkable rush of activity engulfed nearly all markets for both small and large properties. In Far West Texas, the Trans-Pecos region bucked the trend where large property sales continued to languish in the doldrums inspired by collapsed oil prices.

Statewide prices settled at $3,249 per acre, an all-time high for rural properties. Many smaller properties sold, causing the typical tract size to fall 21.63 percent to 1,051 acres. A total of 585,372 acres changed hands, a 20.76 percent increase over 2020. The flood of transactions pushing up prices produced a record total dollar volume in the market of $1.90 billion, up 32.15 percent from last year.

Panhandle and South Plains: Activity moved modestly up in this region with sales increasing 13.87 percent. Prices actually fell 4.51 percent to $1,122 per acre continuing a trend toward lower overall prices. However, the decline decelerated from 2020 results and the total acreage increased 56.42 percent. That increase in acreage cause a 49.37 percent rise in the total dollar volume.

Far West Texas: Activity in the Permian Basin oil play had driven this market for the past several years. When oil prices collapsed in 2020, so did demand for large properties in this region. The number of sales dropped 22.61 percent with acreage falling 65.69 percent. The market focus switched from desert rangelands for energy exploration to desirable mountain properties. So, the region posted few sales at very high prices. The lack of activity makes it difficult to find reliable pricing information.

West Texas: This region experienced robust activity with a 47.46 percent increase in the number of sales and a 2.24 percent increase in price to $1,691 per acre. Total acreage sold exploded up 79.50 percent to 135,556 acres, contributing to the 83.52 percent increase in total dollar volume to $229.2 million. The market was very active with increasing demand pressure.

Northeast Texas: Volume of sales expanded 27.18 percent while prices escalated 12.63 percent to $5,448 per acre. Total acreage increased 22.15 percent to 82,329 acres. These results drove total dollar volume up 37.58 percent to $448.5 million. These developments reflect strong demand emanating from the cities and engulfing the entire region.

Gulf Coast – Brazos Bottom: The volume of sales jumped 44.75 percent from 2020, but the total acres sold only increased 5.88 percent, suggesting a large number of smaller tracts in the current market. Price increased a solid 10.62 percent to $7,031 per acre. The high price but low acreage led to a modest 17.12 percent increase in total dollar volume at $275.1 million.

South Texas: Activity increased substantially in the region to the south of San Antonio with sales volume increasing 27.71 percent and prices remaining steady at $3,952 per acre, virtually unchanged from 2020. Total acres grew 31.29 percent driving total dollar volume up 30.89 percent to $240.9 million.

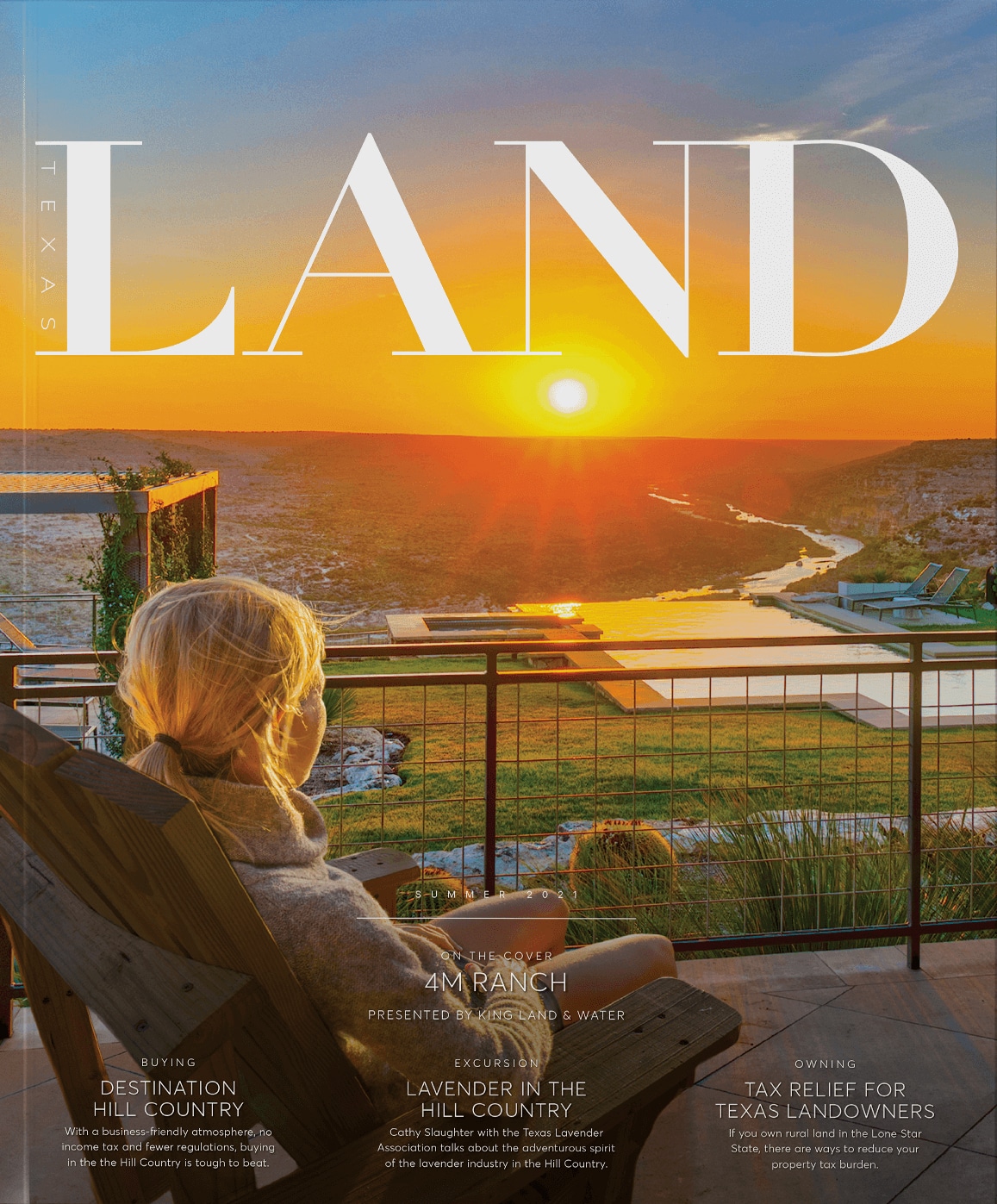

Austin – Waco – Hill Country: Markets in this region posted a solid 7.02 percent increase in price to $4,422 per acre accompanied by a 36.44 percent increase in sales volume. The 23.15 percent increase in total acres sold contributed to the 31.80 percent increase in total dollar volume to $548.8 million.

The desire to escape problems in the urban environment as well as a search for a safe haven for capital has sparked a stampede to the countryside. Undoubtedly, the pandemic and urban unrest prompted this invasion. Many observers fear that market activity at these levels will not last. However, nothing on the horizon points to a diminution in demand for safe space in the countryside. The coming months will likely see a continuing scramble for land with increasing upward pressure on prices. That trend seems likely even if the pandemic does not fade as currently expected. Legions of workers have discovered that they can do their jobs from remote locations, prompting them to seek out places that they prefer to live. At some point, the demand inspired by current societal developments may wane, but no current developments seem poised to cause buyers to retreat.